Housing finance: Boom or bust?

The rapid growth of the mortgage industry in India in the recent years has raised concerns about its sustainability and implications on the country's financial and macroeconomic stability. The IMF, in its World Economic Outlook, 2003 indicated that output losses after real estate crashes in developed countries have, on an average, been twice as large as those after stock market crashes, usually resulting in lasting recessions. The fact that the surge in demand for mortgage credit has been trailed by an equally strong upturn in prices has led to apprehensions as to whether the boom is sustainable or is merely a financial bubble ready to burst. Further, the surge in housing prices globally has gone hand-in-hand with a much larger jump in household debt than in previous booms.

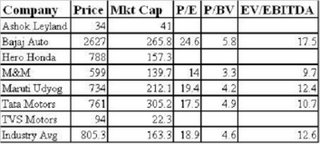

The magnitude of mortgage credit...

The pace of housing sector growth can be gauged from the fact that the total value of residential property in developed economies increased by an estimated US$ 20 trillion to over US$ 60 trillion in the last three years - which is higher than the increase in market capitalisation of global capital markets (Source: IMF). Housing market in India, as evidenced by the growth in bank exposures to the sector, took off mainly since FY01. Credit to the retail mortgage sector grew at a CAGR of 48% between FY01 to FY06 and comprised 12.3% of non-food credit against 3.5% in FY01. Also, as per the RBI's annual statement for FY07, the incremental growth in loans to commercial real estate and housing sectors clocked rates of 84% YoY and 29% YoY respectively in FY06.

Reasons for the surge...

The rapid growth in housing loan market has been jointly supported by the growth in middle class population, favourable demographic structure, relatively lower real estate prices, and more importantly, rise in disposable incomes. Furthermore, attractive fiscal incentives for housing loans make them ideal vehicles for tax planning for the salaried class. For banks and housing finance institutions, the regulatory framework facilitated the higher exposure by prescribing risk weights for housing loans and giving it the benefit of compliance with the targets mandated for priority sector lending. Besides, the loans were backed by the relative safety of such assets given the tangible nature of the primary security and the comfort obtained from the SARFAESI Act, 2002.

Versus the US...

In the United States, which is at present experiencing a strong cycle in the housing market, prices in certain regions have risen sharply if measured against the yardstick of affordability - calculated as the ratio of housing prices to annual income, reflecting a build up of the asset bubble. In fact, at present, the median price of new house in the US is more than 5 times the median household income.

Contrasting this, the scenario is India is still comfortable. At present, the median price of new house in India is 4 times the median household income as against 22 times in 1995. Also, thanks to fiscal incentives, the effective rate of home loan has come down to 4.5% in 2006 against 11.7% in 2000.

It's here to stay!

The mortgage to GDP ratio of 6% in India as against 54% in the US underscores the latent demand for the same. More so, with India being the second fastest growing economy in the world. Another interesting point to note is that while the home loan demand in the developed economies is largely for investment purposes (thus having a speculative component), 70% of the demand in India is for habitation purpose (thus making it less risky). Thus, the housing sector given its core importance in the developmental goals of the economy and in sustaining financial stability - is set to remain on the regulator's radar. However, investors need to judge their stance on the sector based on the fact that even if the current robust rate of growth may not be sustainable, the buoyancy in the sector may linger in the medium term.